Southern India Saree Retailers Set to Generate ₹20,000 Crore Through IPOs, ETRetail

Mumbai: Saree retailers from southern India, including RSB Retail India, Marri Retail, Pothys and Nalli Silk Sarees, are readying to raise nearly ₹20,000 crore through initial public offerings (IPOs) in the next 6-8 months, said bankers with knowledge of the matter.

IPOs offer a way to monetise and create value from the brand equity these ethnic women’s wear retailers have built over decades, they said.

“Most of these saree retailers have so far been concentrated in metro and tier-1 cities in south India,” said Bhavesh Shah, managing director and head of investment banking at Equirus Capital.

With fresh capital, these companies can expand into tier-2 and tier-3 markets, where both population and spending power are increasing. That makes equity funding a good strategy to capitalise on the opportunity, said Shah.

Among such companies, RSB Retail has already filed papers for a ₹1,500 crore issue, while Marri Retail and Pothys are planning IPOs of ₹2,000 crore and ₹1,200 crore, respectively. Heritage saree retailer Nalli Silk is also exploring a public listing.

Emails sent to these companies remained unanswered.

These companies are likely to use the IPO proceeds to expand store networks, invest in supply chains and push for more online sales, riding a wave of consumption-led growth in ethnic wear, according to bankers.

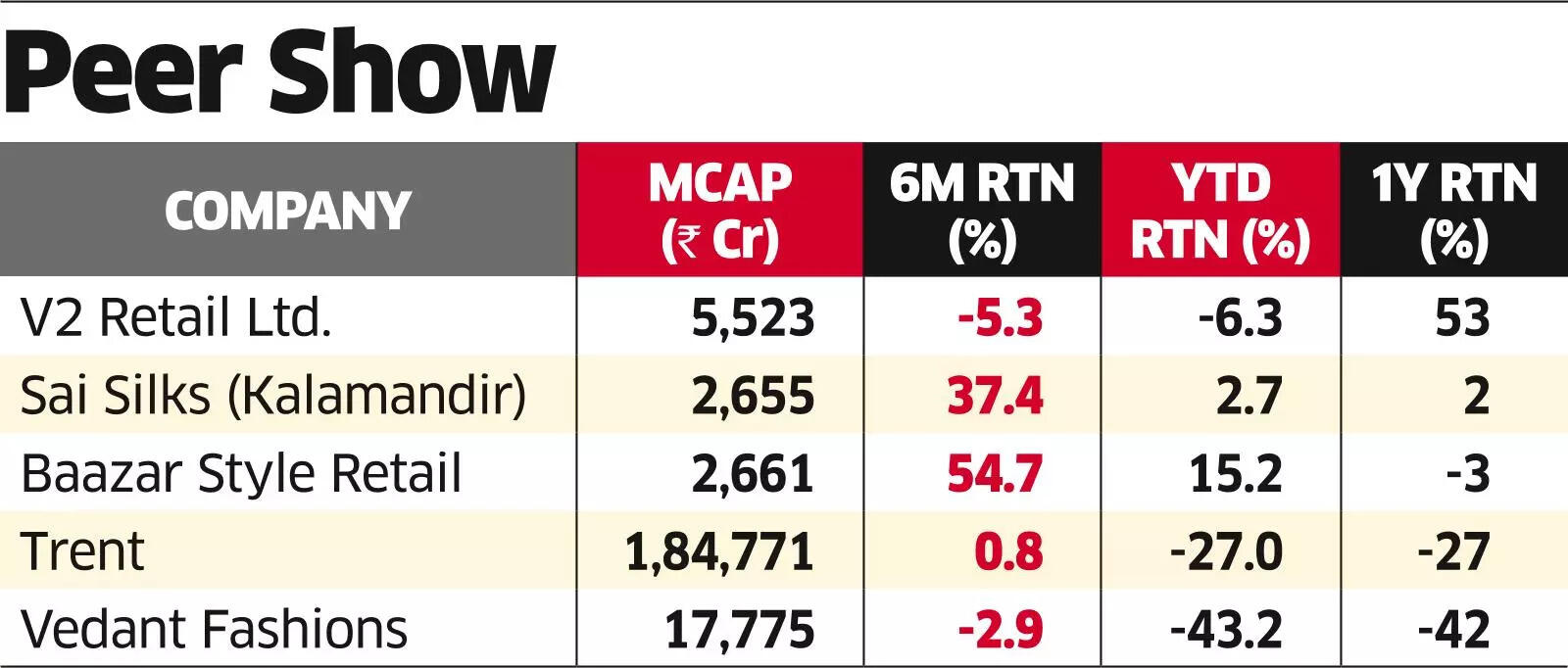

Currently, Hyderabad-based Sai Silks (Kalamandir) is the only listed saree retailer from southern India. Since its listing in September 2023, the company’s stock is down nearly 32% but in the past six months, it has climbed about 27%.

Sarees remain a core cultural product, especially in southern India, with high repeat purchases driven by festivals, weddings and other occasions, according to Vaqarjaved Khan, senior fundamental analyst, Angel One. He said the organised sector’s share is only 30% of the total saree market, offering a headroom for growth to organised players.

“Past listings such as Sai Silks and Vedant Fashions show ethnic wear can command premium valuations if done right as these products have high gross margins of 40-50%,” said Khan.

“Sarees are timeless products with strong cash conversion and low inventory obsolescence.” Amid growing consumption, increasing purchasing power and policy push to boost spending, saree retailers are seizing the moment to go public and scale up.

“In South India, people go above and beyond to spend on occasions and festivals, and if they have to splurge, sarees remain the preferred apparel,” said Bharadwaj Rachamadugu, senior vice-president, Sai Silks (Kalamandir). “Saree as an industry has long been seen as unorganised, while legacy names have been around for a century.”