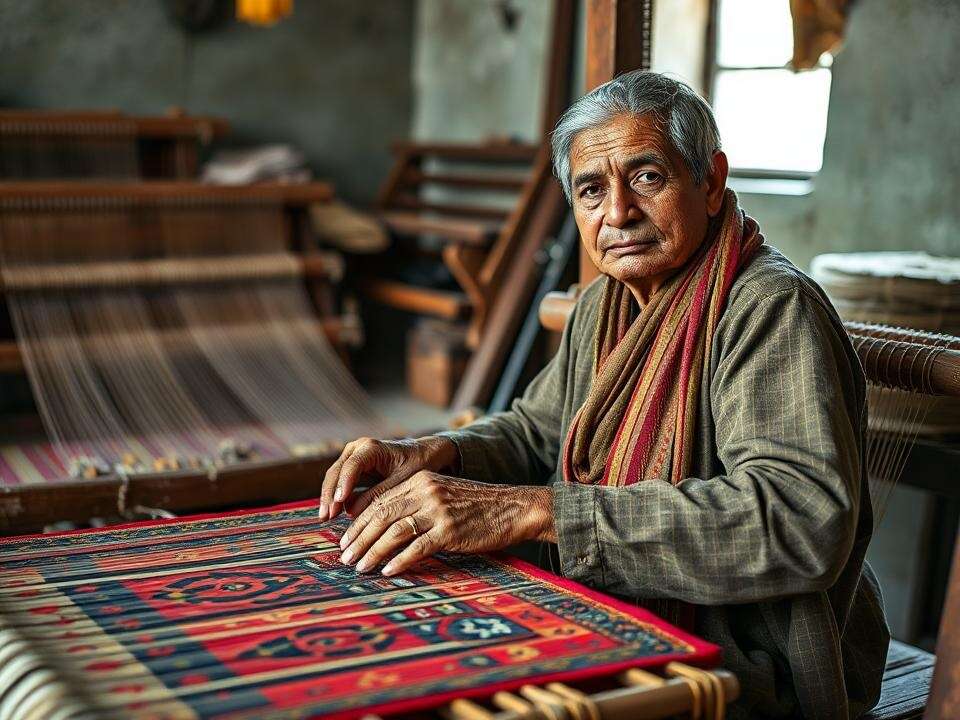

Manufacturers of handmade carpets and floor coverings have welcomed the recent reduction in the Goods and Services Tax (GST) rate from 12 per cent to 5 per cent . They believe that the move will positively impact consumer spending and benefit the local economy. The revised rates, set to take effect from September 22, 2025, are expected to boost exports from clusters such as Bhadohi and Srinagar, strengthen traditional crafts, and improve affordability in the domestic markets.

Industry experts, however, felt that the reforms overlooked certain long-standing aspects. Nishant Chandra, Director, The Carpet Cellar, notes that there has been a demand for a complete waiver of GST on hand-knotted carpets for a long time. “It is an industry that employs tens of thousands of rural artisans working under extremely impoverished conditions. The sector is already facing immense competition from machine-made carpets imported from China, Turkey, Iran, and other regions, as well as significant uncertainty due to tariffs imposed by the US, which remains our largest export market,” he says.

Last month, the carpet industry sought a special bailout package for exporters to mitigate the impact of 50 per cent tariffs imposed by US President Donald Trump, according to a media report. The All India Carpet Manufacturers’ Association (AICMA) and the Carpet Export Promotion Council (CEPC) recently convened with Union Textiles Minister Giriraj Singh regarding this matter.

Elaborating further on GST reforms, Chandra notes that all imported raw materials, such as wool, cotton, and silk, are already subject to GST. “Consequently, the imposition of GST on the finished product, even though reduced from 12 per cent to 5 per cent , places an additional burden on the industry,” he explains. In his view, a complete exemption from GST would have been far more beneficial, providing much-needed relief to the lakhs of artisans engaged in centuries-old traditions of vegetable dyeing, spinning, and weaving that define this heritage craft.

The Indian handmade carpet industry is a significant contributor to the economy, providing employment to over 20 lakh workers and artisans, especially women, directly or indirectly in the rural areas. Uttar Pradesh, Jammu & Kashmir, Rajasthan, Haryana, Punjab, Himachal Pradesh, Gujarat, Tamil Nadu, the northeast region of India, Andhra Pradesh, Odisha, Telangana, Chhattisgarh, and Jharkhand are the major carpet-producing centres in the country.

Others in the industry viewed the GST reforms as a step in the right direction, with the tax rate on all man-made fibres, also known as synthetic fibres, down to 5 per cent from 12 per cent . “The input credit will not get accumulated; instead, it will get set off. People will look more aggressively now at the Indian retail and consumer market; 5 per cent GST doesn’t seem to be much in comparison to the tariffs overseas,” says Mahavir Pratap Sharma, Director, Oscar Exports, a leading exporter and manufacturer of handmade woollen and hand-knotted woollen carpets.

Experts are also of the view that the reforms offer room for making tax compliance easier for small weavers and manufacturers. “Aligning all carpet-related categories like knotted/woven/tufted/felt carpets and handmade/handcrafted carpets under one GST slab reduces classification ambiguity and administrative friction. Overall, artisan-heavy zones, including Kashmir, which were suffering high taxation and export impact, should get a much-needed boost,” states Paresh Parekh, Partner and National Leader for Tax-Consumer Products and Retail Sector, EY India.

Affirming his views, Yogesh Chaudhary, Director, Jaipur Rugs, states that the bigger story is one of simplification. “Faster refunds and easier compliance mean businesses like ours can stay more resilient. In a global environment that is so unpredictable, any step that eases liquidity is a welcome cushion,” he highlights.